So, John, let’s start a little bit with, what were you doing at The Motley Fool? John: I’ve been to Colombia several times, and one of the best restaurants I’ve been to in Colombia was a Peruvian restaurant. Jake: Time for our obligatory geography lesson? Let me do a little shoutout to all in the house. I’m not very creative when it comes to names, and wasn’t taken. I do try to take care of myself, so I want to grow my muscles and all of these things. Then, I have a growth mentality, not investing philosophy. I got on Twitter just about two years ago, and I started playing with– I wanted to do JRO for Show, but that was, believe it or not, taken. John: First of all, thanks for having me, Tobias and Jake.

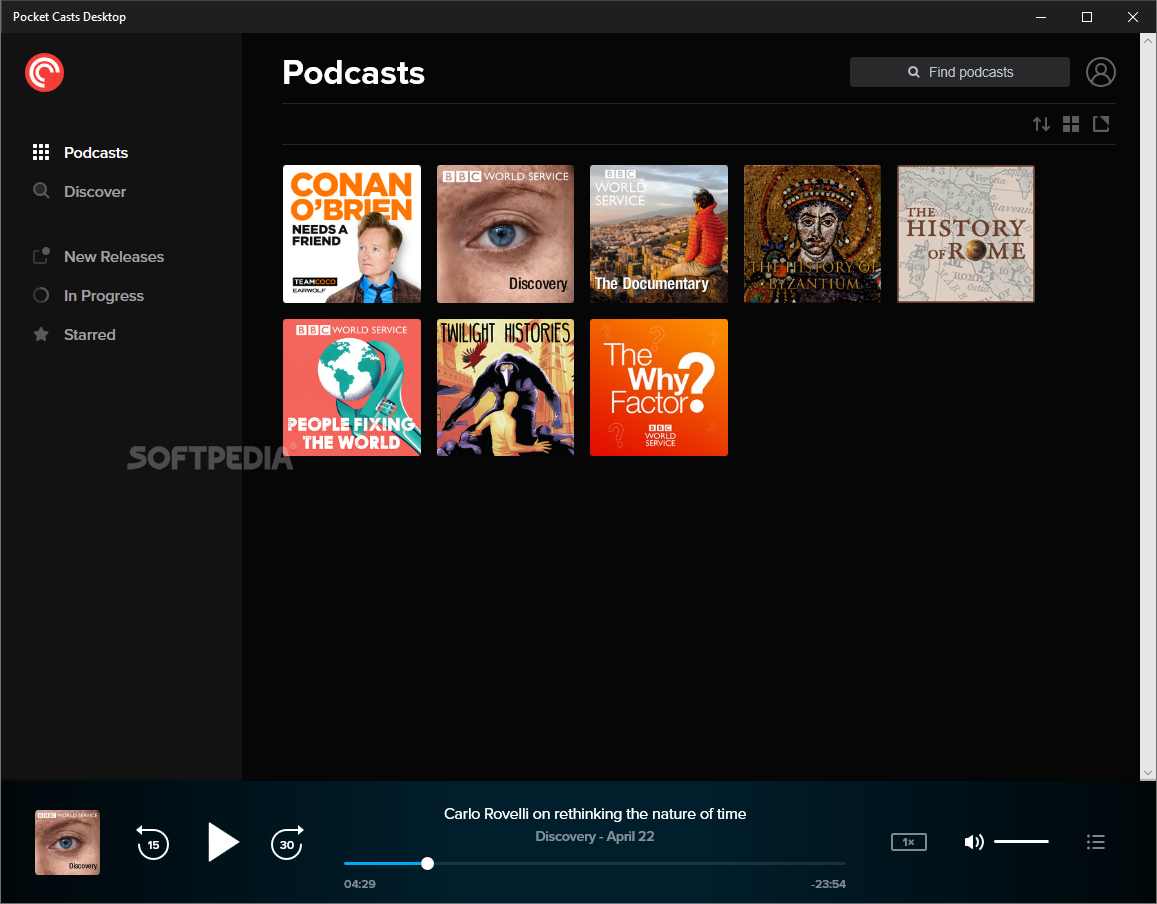

Pocket casts logo free#

Tobias: -individual investor, free agent, running one of the best Twitter accounts out there, What’s the name behind the name there? Or what’s the story behind the name for that? Very special guest today, John Rotonti, formerly of The Motley Fool. What’s up, everybody? I am Tobias Carlisle, joined as always by Jake Taylor.

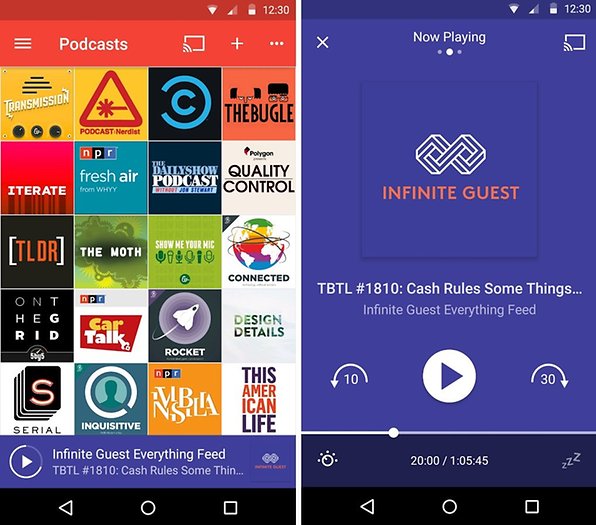

Tobias: This meeting is being livestreamed. You can also listen to the podcast on your favorite podcast platforms here: You can find out more about the VALUE: After Hours Podcast here – VALUE: After Hours Podcast. Value Investing – 3 Points Of The Triangle.Why Truist Financial Stock (TFC) Is A Good Investment.Oil & Gas – The Long-Term Demand Outlook Is Strong & Growing.

Why The Inversion Indicator Is Such A Good Predictor.Multi-Billion Dollar Valuations Used To Mean Something.Key Take-Aways From The Berkshire Annual Meeting.If Warren Buffett Had Used Banking Instead Of Insurance For His Float.Berkshire Hathaway – Retained Earnings Machine.What Happens To You Physically During A Market Crash.Warren Buffett Buys Wonderful Companies Cheap.In their latest episode of the VALUE: After Hours Podcast, John Rotonti, Jake Taylor, and Tobias Carlisle discuss:

0 kommentar(er)

0 kommentar(er)